Hello Friends !!!

Welcome to fifth episode of Top 10 Best Series. In this series we will uncover top 10 best things or moments across different niches & subjects. Today we will start this episode with Top 10 best performing defense stocks of 2025. Defense sector driven by country’s strategic importance & made in India self reliant policy is undergoing significant growth. Government of India has been ramping up efforts to modernize military & boost defense domestic production with improvements in technology. We will understand what all companies will benefit from defense sector & what all are top 10 best performing defense stocks of 2025.

Overview of India’s Defense sector .

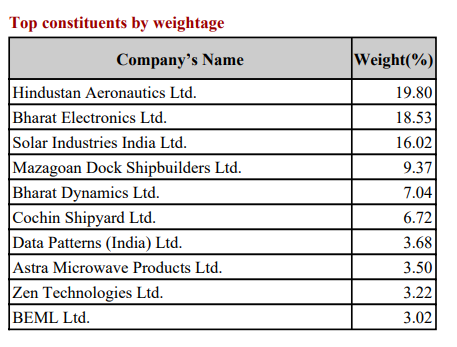

- The Nifty India Defence Index which aims to track the performance of portfolio of stocks that broadly represent the Defence theme. From the Nifty Total Market index, stocks forming part of eligible basic industries or those which obtain at least 10% of revenues from the defence industry are eligible to be included in the index and are chosen based on 6 month average free-float market capitalization. The weight of the stocks in the index is based on their free-float market capitalization. Stock weights are capped at 20%.

Top 10 best performing defense stocks of 2025

1. Hindustan Aeronautics Limited (HAL)

Hindustan Aeronautics Limited is a leading aerospace and defence manufacturer, offering aircraft, helicopters, and advanced systems for both civil and defence sectors. It is among the largest and oldest manufacturers globally. Stock price has appreciated to 5000 INR from this year lows of 3000

Financial Highlights:

Revenue Growth: 13% YoY increase in FY24 to ₹30,381.08 crore.

Profit Growth : 30% YoY growth in FY24.

Five-Year Revenue CAGR: 9.65%, above the industry average of 8.49%.

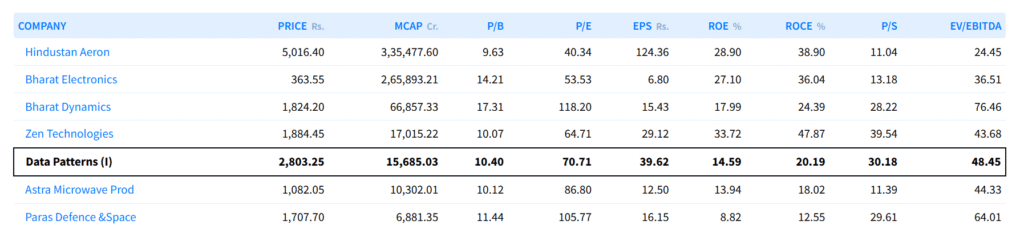

2. Bharat Electronics Limited (BEL)

Bharat Electronics Limited produces electronic systems for defence and non-defence sectors, including radars, communication systems, and missile systems. BEL is currently trading around 360s recovered from low’s of 240s this year

Financial Highlights:

Revenue Growth: Robust growth across sectors in FY24 & 34% YOY Profit growth

Expanding Operations: Increasing presence in non-defence sectors like e-mobility and homeland security.

Five-Year Revenue CAGR: 10.79%

3. Solar industries Limited (SOLARINDS)

Solar Industries is an India-based manufacturer of industrial explosives for the mining & infrastructure sector. Company offers industrial explosives & defence products. Currently at 14000 recovered from lows of 8500.

Financial Highlights:

Five-Year Revenue CAGR: 17.5 %

Profit Growth : 34% YoY growth in FY24.

4. Bharat Dynamics Limited (BDL)

Bharat Dynamics Limited specialises in guided missile systems, underwater weapons, and defence equipment. It also offers lifecycle support and refurbishment services. Current Stock Price is 1800 almost doubled from it’s lows in Feb 2025.

Financial Highlights:

Profit Growth : 74% YoY increase in FY24 to ₹612.3 crore.

Three-Year Revenue CAGR: 10.79%.

Debt-to-Equity Ratio: A low 0.36% average over five years.

5. Mazagon Dock Shipbuilders Limited

Mazagon Dock Shipbuilders is renowned for its expertise in constructing warships, submarines, and engineering products for naval defence. It is currently trading around 3400 levels.

Turnover in FY24: ₹9,466.58 crore, a 20.94% YoY growth.

Profit Growth : 72% YoY increase in FY24 to 1845 Crores.

6. Paras Defence and Space Technologies

Paras Defence supports India’s defence and space missions with advanced equipment and technologies, focusing on innovation and diversification into space technology. It is currently trading around 1700 levels

Financial Highlights:

Revenue Growth: 10.74% annual growth over the last five years.

Profit : Net Profit in 2024 FY was around 34 Crs

Expanding Capabilities: Continuous growth in space and defence markets.

7. Cochin Shipyard Ltd.

It is leading player in construction of all kinds of vessels, repairs & refits of all types of vessels inlcuding periodic upgradstion & life extension of ships. It has developed expertise from building bulk carriers to smaller ships which are advanced in terms of technology , it has moved to 2000 levels up from 1200 levels

Financial Highlights:

Revenue Growth: 9% annual growth over the last five years

FY 2024 : 56% YoY Revenue growth & 140% profit growth

Healthy Dividend Payouts.

8. Data Patterns

Data Patterns one of the vertically integrated defence & Aerospace electronics solution providers which focus on in house development & manufacturing led by innovations & design. It supplies products catering to all platforms including products for Tejas, Brahmos, Light Utility Helicopter. Stock is almost doubled & currently trading at 2800 levels this year

Financial Highlights:

Revenue Growth: 53% annual growth over the last 3 years.

Profit Growth :165% over five years.

Zero Debt Company

9. Zen Technologies

The company designs , develop & manufactures combat training solutions & Counter drone solutions for defence & security forces. Stock is 80% up this year & currently trading at 1800 levels

Financial Highlights:

Revenue Growth: 36% annual growth over the last five years.

Profit Growth :47% over five years.

Zero Debt Company

10. Astra Microwave Products Ltd.

The Company is engaged in the business of design, development & manufacture of sub-systems for radio frequency & microwave ssytem used in defence , space , metrology & telecommunication. It is trading at 1100 levels.

Financial Highlights:

Revenue Growth: 26% annual growth over the last five years.

Profit Growth :55% over five years.

Debt to Equity ratio is low

This was all about top 10 best performing defense stocks of 2025 , where we have witnessed journey into premium upcoming variants. Stay tuned for next episode !!!