Solar revolution in India started in 2010 and in 2012 India reaches 1 GW Solar Capacity & today in 2025 we have 110 GW of Solar Capacity. The Government of India has taken aspirational target of reaching 250 GW of Solar Capacity in next 4.5 years which will require lot of Players to come and contribute to target which we have achieved as nation in 15 years. There are upcoming & established players in market like Waaree Energies, premier energies & Vikram Solar which already contributes & planning to expand. Lets understand Solar race for India 2030 Vision – Waaree vs Premier vs Vikram Solar.

What these companies do – understanding business model ?

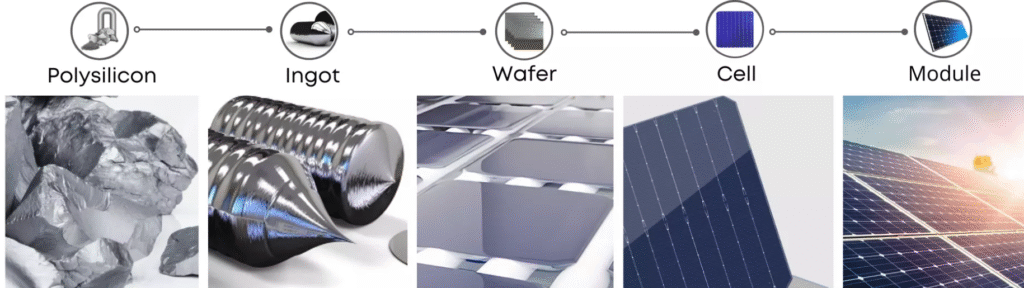

All three companies work on diversified products portfolio for growth – upcoming solar ambition for nation & BESS (Battery Energy Storage Systems). Solar Panel systems are major end products which are made by these companies. To make solar panels – few other important components are required which are solar modules , solar cells , wafers & ingots. Let us look into what are current and future capabilities for all three.

Comparison of Module Capacity, Cell Capacity & Wafers/Ingots for all 3 Players

1. Waaree Energies : Module Capacity : Current 15 GW , Target FY 27 : 26 GW , Cell Capacity : Current 5.4 GW , Target FY 27 : 16 GW , Wafer / Ingots : Largely dependent on China Imports – 6 GW Factory is under development (By 2027)

2. Premier Energies : Module Capacity : Current 5.1 GW , Target FY 27 : 10 GW , Cell Capacity : Current 3.2 GW , Target FY 27 : 8 GW , Wafer / Ingots : 2 GW Joint ventures which can scale up to 10 GW (FY 28)

3. Vikram Solar : Module Capacity : Current 4.5 GW , Target FY 27 : 20 GW , Cell Capacity : Current 0 GW , Target FY 27 : 12 GW (Tamil Nadu) , Wafer / Ingots : 4 GW Joint Ventures development (FY 26- 2027)

Comparison of BESS Capability.

1. Waaree Energies : 3.5 GW Lithium Ion Cell & Energy Storage Systems facility estimated operational by FY 27

2. Premier Energies : Created subsidiary for storage solutions , expected contribution to revenue from FY 27.

3. Vikram Solar : Bess integrated in EPC Strategy (Batteries to be outsourced from other companies like Amara Raja)

All 3 Companies have 2 growth avenues – upscaling Solar Panel productions & investing in BESS business moving forward when solar becomes saturated.

FY Results & Financial Parameters

1. Waaree Energies : 49% CAGR Sales growth in last 5 Years. Order Book estimated 49000 Crores which is almost 3 times Current FY Revenue which ensures long term revenue visibility for it’s stakeholders. Management guidance on FY 26 is 5000 Cr + EBITDA which means strong 40% and upwards growth ensuring good valuation buy for stakeholders.

2. Premier Energies : 47% CAGR Sales growth in last 5 Years. Order Book estimated 8600 Cr which is almost 1.3 times of Current FY revenue which ensures short term revenue visibility for it’s stakeholders. Currently they are operating at maximum capacity and when capacity expansion is done that will be future growth driver. As per Management their future growth will be from scaling solar business and inverters along with Bess. Margins will be improving due to high capacity utilization.

3. Vikram Solar : 16% CAGR Sales growth in last 3 Years & 26% in last 3 Years. Recent IPO – Company aims to raise 2079 crore through fresh equity & offer for sale. Expansion plans to 20.5 GW from 4.5 GW by FY 27 to aim at 2030 Solar Targets by Government of India