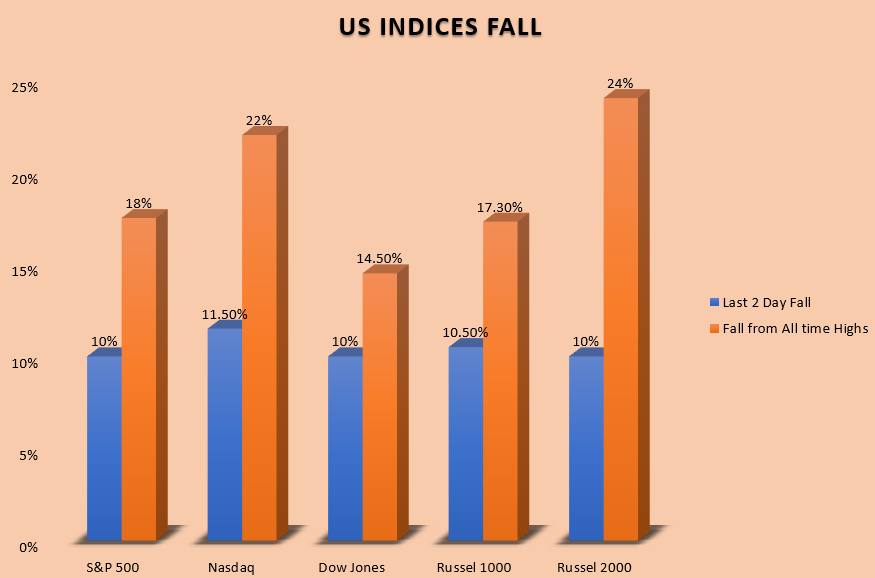

Recent Developments in reciprocal tariff on rest of the world by US President resulted in US Stock Market Crash after tariff decision resulting in S&P 500 Index sinks by almost 10% while Nasdaq nosedives around 11.4% in just 2 days wiping out trillions of dollars from Wall Street. Dow Jones is down by 10% along with broader market indices Russel 1000 & 2000 down as well. Nasdaq & Russel 2000 indices are slowly entering into Bear Zone with fear of recession & US Economy

Nasdaq Composite : With this recent US Stock Market Crash after Tariff decision, Nasdaq 100 is down by over 20% from it’s all time highs.

1. Apple falls by 7.3% yesterday as there is fear due to new tariff, it’s production cost got get impacted due to which there can be potential price increase which may dampen volumes & overall growth. Overall Stock has dropped overall 25% till date, reflecting concerns from investors on margins & earnings. It has been one of the laggards so far in overall US Stock Market crash in last 2 days as well

2. Microsoft Corporation is experiencing significant stock declines due to tariffs & weak revenue guidance but company shows strong growth in AI Services with 157% increase in revenue year on year. The Company continue to invest heavily in AI Infrastructure protecting future growth despite competitive pressure from rivals. YTD stock has declined by 14% this year.

3. NVIDIA Corporation : Nvidia is facing similar stock decline challenges as rest of the constituents of Nasdaq Composite due to concerns over valuation, market sensitivity & new trade tariff’s. Despite strong revenue growth & plans, market sentiments remains cautious & few analysts have downgraded stock like HSBC citing weakening GPU Pricing Power. The stock has experienced significant volatility & has fallen over 30% this year so far from Jan highs of 140+ levels.

4. Amazon : Stock faces pressure leading to 7.4% downside movement in yesterday’s session & Overall it has corrected by over 20% from Jan Highs. Amazon has been focusing advancements in AI particularly in AWS division which is expected to drive robust profits. Amazon is also actively pursuing a bid for Tik-Tok while also launching satellites for it’s internet project. Despite it’s efforts to diversify business segments , it is facing sell off pressure due to concern over tariffs

5. Google : Alphabet Inc. is navigating challenges recently with significant stock buybacks & new initiatives like YouTube Shorts Tools, while facing revenue concerns from tariffs. Overall stock has declined over 20% YTD this year citing threats from AI Competition & reduced advertising spendings. Analysts remains divided on the stock, some maintained buy ratings with good Q4 results waving path for it’s recovery & favorable valuations currently trading around 18 PE ratio while other remains cautious over revenue concerns due to reciprocal tariffs in action

Apart from above stocks, rest stocks which participated in US Stock Market crash after tariff, Meta Platforms which operated Facebook & Instagram is facing sell off and is down over 30% from it’s highs of 700+ earlier this year. Similar pressure can be witnessed in rest of the stocks including Broadcom, Costco & Netflix. Tesla story have been similar & it is the one of the worst performers with over 35% wealth erosion for investors this year so far. Tesla Q1 2025 deliveries fell by 13% , missing estimates & leading to decline in value. There concerns over brand perception, competition from rest part of world while news of Elon Musk stepping back from government roles , upcoming catalysts like Robotaxi segment , lowered price models may boost shares in future

As of now investor segments will remain cautious & all eyes will be on key developments coming in upcoming week & further news from White House will definitely plays key role in future roadmap for US Markets